Did you know that India’s silver imports ascended from 560 tonnes to a whopping 4,554 tonnes in just the first quarter of this year? It speaks volumes about the growing interest in silver among Indian investors. Yes. While gold often takes the spotlight as the ultimate safe-haven asset, silver is carving out its own niche with its significant industrial applications and unique economic conditions.

In this blog, we’re diving deep into silver investment in India. Whether you’re an experienced investor or just starting out, we will help you understand everything about how to invest in silver. We will also cover everything from the basics of silver investment to specific strategies, market influences, and regulatory frameworks. Let’s get started!

What Does Investing in Silver Mean?

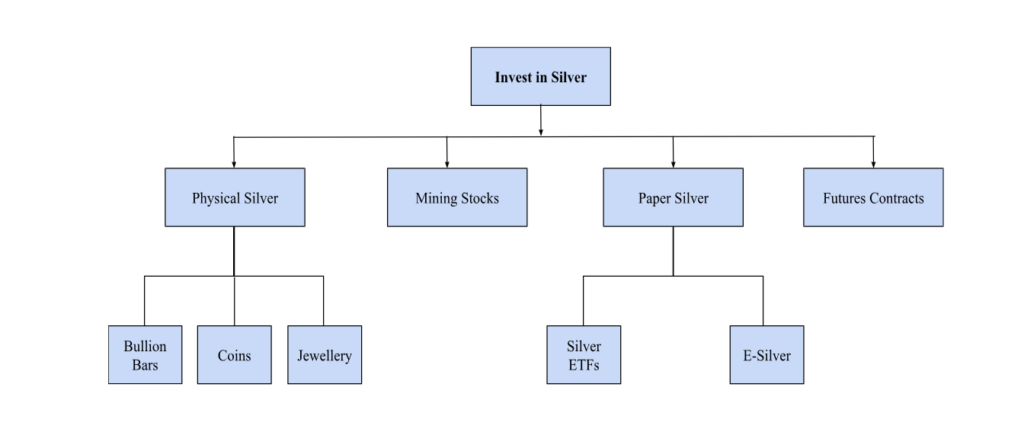

Investing in silver is about more than just purchasing a precious metal. It stands as a symbol of wealth and cultural heritage, representing both tradition and contemporary relevance. Beyond exquisite jewellery, silver coins, bars, bullions, and various financial instruments like Exchange-Traded Funds (ETFs), mining stocks, e-silver, silver futures, and mutual funds are gaining popularity, all with the expectation of generating returns over time.

The importance of silver investments today extends well beyond the decorative value and appeal. Its exceptional electrical conductivity renders it indispensable in various industries, including electronics (where it is used in batteries, electric contacts, and circuit boards), healthcare (in medical devices and dental alloys), and renewable energy (such as solar panels). This diversity ensures a reliable demand for the metal.

As per the current market, silver also serves as a hedge against economic downturns and inflation. Investors can choose from several avenues, such as physical silver, mining stocks, and silver ETFs, to diversify their portfolios for both growth and stability.

You may also like to read:

- A Comprehensive Guide to Gold Hedging: Protecting Your Investments

- Top Investment Ideas for Beginners: A Step-by-Step Guide to Start Your Journey

- How to Make Extra Income While Working Full-Time: Practical Strategies for Busy Professionals

Why Invest in Silver?

Silver is a popular choice among investors who want to protect their wealth from inflation and market volatility because it is a more affordable alternative to gold. There are several advantages to silver investments, including hedging against inflation, liquidity, portfolio diversification, and affordability.

However, before making any investment decisions, it’s important to consider some important factors, such as your specific investment goals and risk tolerance. Moreover, one must conduct thorough research as the silver market can be quite volatile. Taking these steps can help you make informed choices and optimise your investment strategy.

What Makes the Price of Silver Move?

Silver investment prices are influenced by several factors. This includes the dynamics of supply and demand, in which a limited supply and consistent demand can cause significant price fluctuations.

Silver prices tend to rise during periods of high inflation and decrease during periods of low inflation. Government policies such as taxation and tariffs also affect silver’s market value. Also, industrial demand, particularly from the electronics and renewable energy sectors, can drive prices upward.

Technological advancements and geopolitical circumstances, such as trade disputes or conflicts, can influence supply and demand. Investor sentiment and speculative trading also play a critical role, as silver is often viewed as a safe-haven asset during times of economic uncertainty.

How to Buy and Trade Silver?

Investors interested in purchasing and trading silver have a wide array of options available to them, each tailored to individual preferences and risk tolerance. One option is buying physical silver from a reputable dealer, such as bullion bars and coins. This option is simple and offers the advantage of tangible ownership, but it does require secure storage and may involve higher premiums.

Another physical option is investing in silver jewellery or decorative items, which can be aesthetically appealing but may contain other metals like zinc or copper and are primarily for ornamental purposes. For those who prefer not to handle physical storage, there are silver paper options like exchange-traded funds (ETFs) and e-silver. These investment vehicles offer convenience and do not require physical storage, but SEBI regulates them and may involve fees and counterparty risks.

In addition to these options, investors can also engage in trading silver through futures contracts. This approach provides the possibility for higher returns, but it also carries significant risks. Meanwhile, investing in mining stocks can provide exposure to the silver industry through dividends and diversification. Still, it’s important to note that this approach is subject to stock market risks.

Ultimately, the decision on how to buy and trade silver depends on individual financial goals and risk appetite. Each option has its own set of advantages requiring investors to carefully evaluate these factors before making a decision.

Read more about:

- FAQ About NRI Mutual Fund Investments – All your Questions Answered

- 11 Child Investment Plans in 2025: Investing for Your Child’s Future – Guide

- Investment Plans for Housewives: Smart Strategies for Financial Independence

How Does a Silver ETF Work?

A silver ETF (Exchange-Traded Fund) is a type of investment fund designed to track the price of silver in the market, allowing investors to own a portion of the silver held by the fund. This option falls under the category of paper silver, making it an attractive choice for those looking to invest in silver without the complexities associated with physically purchasing, storing, and protecting the metal.

Silver ETFs provide liquidity and ease of trading, as they can be bought and sold on stock exchanges like regular stocks. However, it’s important to note that trading silver ETFs carries inherent risks, including market volatility, potential tracking errors, and the possibility of losing principal investment. Always consider these factors when deciding whether to include silver ETFs in their investment strategy.

What Are Some Top Features of Silver ETFs?

When evaluating the potential of investing in a silver ETF, it is essential to understand some of the top key features that these investments offer:

- Liquidity: Silver ETFs are traded on major stock exchanges, ensuring high liquidity. Investors can easily buy or sell shares throughout the trading day, making it convenient to enter or exit positions quickly.

- Diversification: Investing in a silver ETF allows exposure to a broader range of silver assets without purchasing physical silver. This diversification can reduce risk compared to investing in individual silver stocks or commodities.

- Cost-Effectiveness: Silver ETFs typically have lower fees compared to actively managed funds. This cost efficiency makes them an attractive option for investors seeking exposure to silver without high management costs.

- Transparency: Most silver ETFs regularly disclose their holdings and performance metrics, providing investors with a clear understanding of their investment. This transparency helps build trust and allows for informed decision-making.

- No Storage Concerns: Unlike physical silver, which requires secure storage and insurance, silver ETFs eliminate the need for physical storage. Investors can gain exposure to silver without worrying about security and protection costs.

- Regulated Investment: Silver ETFs are subject to regulation by financial authorities, providing a level of investor protection. This oversight ensures that the fund operates fairly and transparently, instilling confidence in investors.

- Possibility for Dividends: Some silver ETFs may distribute dividends from the income generated by the underlying silver holdings. This feature can provide investors with an income stream in addition to price appreciation.

Apart from the above features, there are some key points regarding the taxation of silver ETFs:

| Taxation of Silver ETFs | ||

| Tax Aspects | Description | Details |

| Capital Gains Tax | Profits from selling shares of silver ETFs are subject to capital gains tax. If the ETF is held for more than one year, it may qualify for lower long-term capital gains rates. Short-term gains, on the other hand, are taxed at ordinary income rates. | Short-term Capital Gains: Up to 37% (taxed as ordinary income)Long-term Capital Gains: 0%, 15%, or 20% (depending on taxable income) |

| Collectibles Tax Rate | Gains from the sale of silver ETFs are subject to a maximum collectibles tax rate of 28%, as silver is classified as a collectible by the IRS. This rate applies regardless of how long the investment is held. | Maximum Rate: 28% (applies to all gains on collectibles) |

| Dividends | Any dividends paid by silver ETFs are typically taxed as ordinary income. The tax rate on these dividends depends on the investor’s income bracket. Some dividends may qualify as “qualified dividends”, which are taxed at lower rates. | Ordinary Income Tax Rate: Ranges from 10% to 37% Qualified Dividends: Taxed at 0%, 15%, or 20% (based on income level) |

| Tax-Advantaged Accounts | Investing in silver ETFs within tax-advantaged accounts such as IRAs or 401(k)s allows investors to defer taxes on capital gains and dividends until withdrawals are made, potentially resulting in significant tax savings over time. | Tax Deferral: Taxes are deferred until withdrawal, allowing for tax-free growth during the investment period. |

| State Taxes | State tax treatment of capital gains can vary significantly. Some states do not tax capital gains, while others may impose rates as high as 13.3%. Investors should consider state-specific tax regulations when investing in silver ETFs. | State Tax Rates: Varies widely by state, typically ranging from 0% to 13.3% on capital gains. |

It is recommended to seek guidance from a qualified financial advisor to make well-informed decisions regarding these investment options. A financial advisor can comprehensively assess your financial situation, understand your investment goals and risk tolerance, and provide insights into the specific features of the ETFs you are interested in.

Things to Consider Before Investing in Silver ETFs

Just as with any investment options available, it’s important to consider a few factors before investing in silver EFTs. This includes:

- Understanding Market Trends: Understanding the trend is important. Monitor and stay updated on global economic indicators like inflation rates, interest rates, and socio-economic trends, or geopolitical events that affect silver prices.

- Diversify Investments: Diversify your investment by combining different forms of investments instead of putting all your capital into one asset class. You can try various options including physical silver along with ETFs for better risk management.

- Understand Global Influences: It’s important to understand how international events and economic crises abroad impact local markets.

- Storage Solutions: If you are investing in physical silver, you must consider secure storage options such as bank safety deposit boxes or specialised vaults designed for precious metals.

SEBI Rules for Silver ETF

The Securities and Exchange Board of India (SEBI) plays a vital role in overseeing and regulating various financial instruments, including exchange-traded funds (ETFs). This is crucial for maintaining a fair and transparent market environment and ensuring investor protection. SEBI has put in place comprehensive regulations such as:

- Mandatory disclosures by fund houses regarding holdings and performance metrics.

- Regular audits conducted by independent auditors ensure compliance with regulations.

- Investor education initiatives aimed at increasing awareness about risks associated with investing in ETFs.

These regulations aim to protect investor interests while promoting transparency within the market landscape.

Conclusion

Investing in silver ETFs is a great alternative to investing in physical silver. ETFs provide a high level of safety and liquidity, allowing investors to benefit from the increase in the price of silver. Mutual funds can also be a reliable option for investors interested in silver investments. It’s important to consider factors such as financial goals, market trends, tax implications, and regulatory frameworks.

At Pentad Securities, a leading financial product distribution and brokerage service provider, we analyse your investment plans and suggest the best options to maximise profits. Connect with us now to learn more about the most convenient silver ETF investment options.