If you’re planning to become an Authorised Person (AP) in the securities market under Pentad Securities, here’s a comprehensive guide to help you understand the process, requirements, and associated fees. This guide covers the documentation checklist, fee structure across exchanges, registration steps, and office requirements.

✅ Checklist for Appointment of Authorised Person (Individual)

Before initiating the registration process, make sure you have the following documents ready:

- PAN Card Copy

- Residential Address Proof

- Educational Proof (Minimum qualification: 10th Pass)

- Bank Proof

📊 AP Registration Details Across Exchanges

| Activity | NSE | BSE | MCX |

|---|---|---|---|

| AP Registration | ₹5,000 + GST per segment | ₹4,000 + GST per segment | ₹2,000 + GST per segment |

| AP Cancellation | Nil | ₹1,000 | ₹2,000 |

| Annual Maintenance Charge (AMC) | ₹5,000 + GST (all segments) | ₹4,000 (all segments) | ₹250 per quarter |

| Processing Fee | ₹500 | ₹500 | ₹500 |

💳 Payment Details for AP Registration & Cancellation

Ensure payments are made to the account below for all NSE-related AP activities:

- Account Title: PENTAD SECURITIES PRIVATE LIMITED – NSE CASH PROPRIETORY ACCOUNT

- Account Number: 200999655681

- IFSC: INDB0000033

📝 Processing Steps for AP Registration

- Draft Agreement – Created based on submitted documents.

- Agreement Execution – Signed on stamp paper after confirmation.

- Uploading – The signed agreement is uploaded to the respective Exchange portal.

- Approval – Upon approval by the Exchange, the AP Code will be issued.

- Intimation – Confirmation and AP code are sent via registered email.

🏢 Requirements in AP Office

To ensure compliance and readiness for operations, the following must be maintained in the AP’s office:

- SEBI Registration Certificate

- Visitor Register

- Complaint Register

- Pentad Securities Name Board

- Recorded Telephone Line (if trading terminals are provided)

- AP Registration Certificate

Becoming an Authorised Person is a crucial step toward building your presence in the capital market ecosystem. Ensure that all documentation and office compliance requirements are strictly adhered to for a smooth and successful registration process.

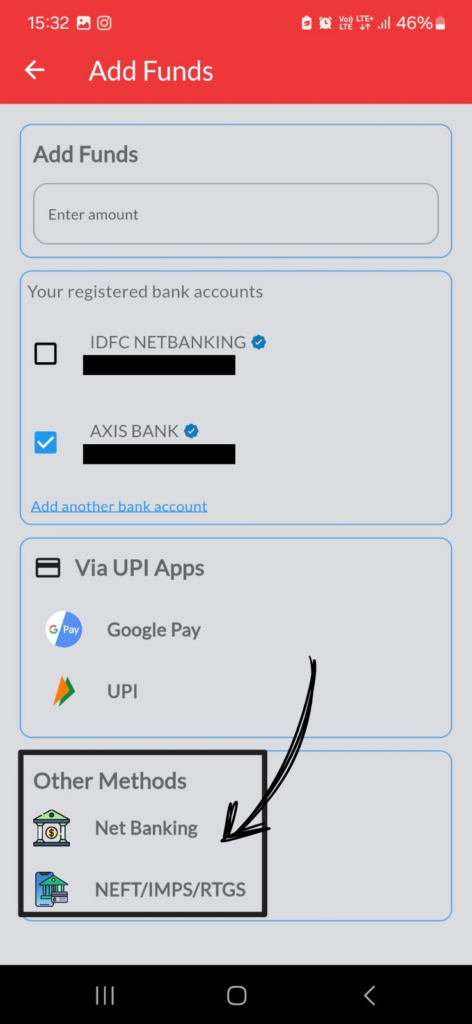

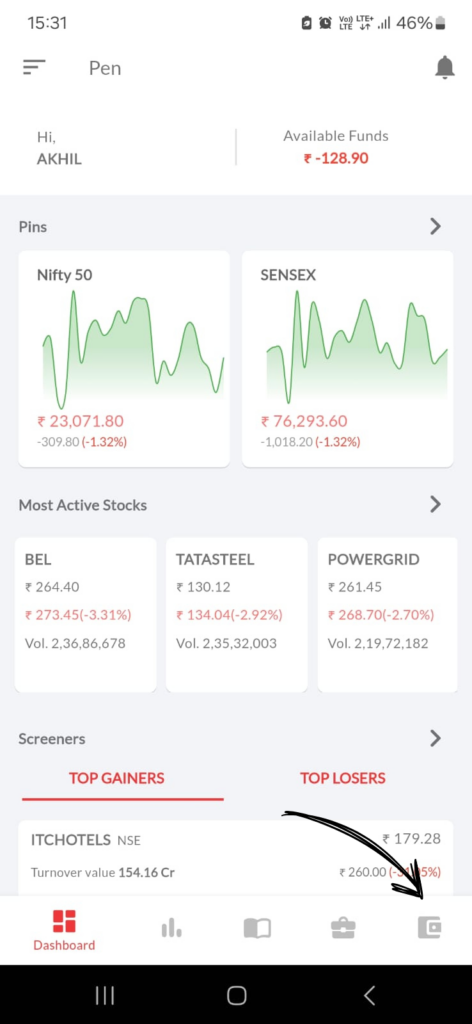

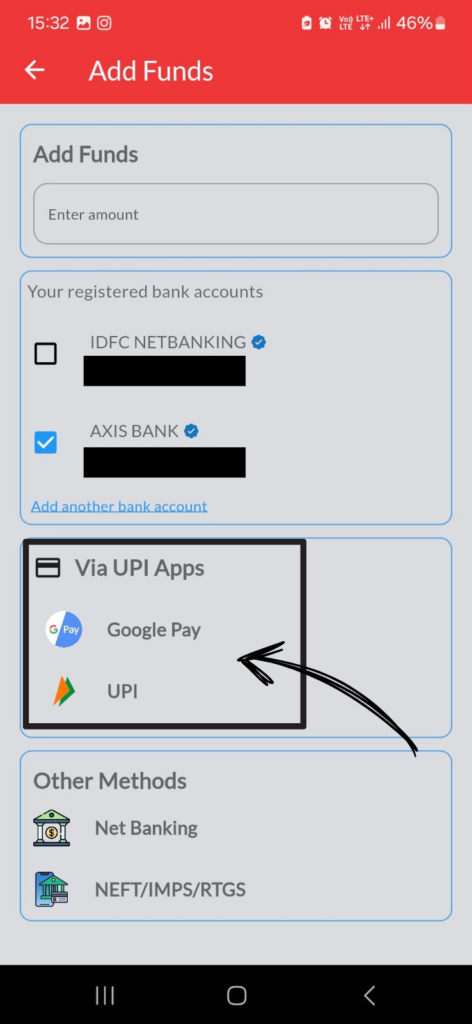

Open Pen App :

- Tap on icon [ ]at bottom right corner.

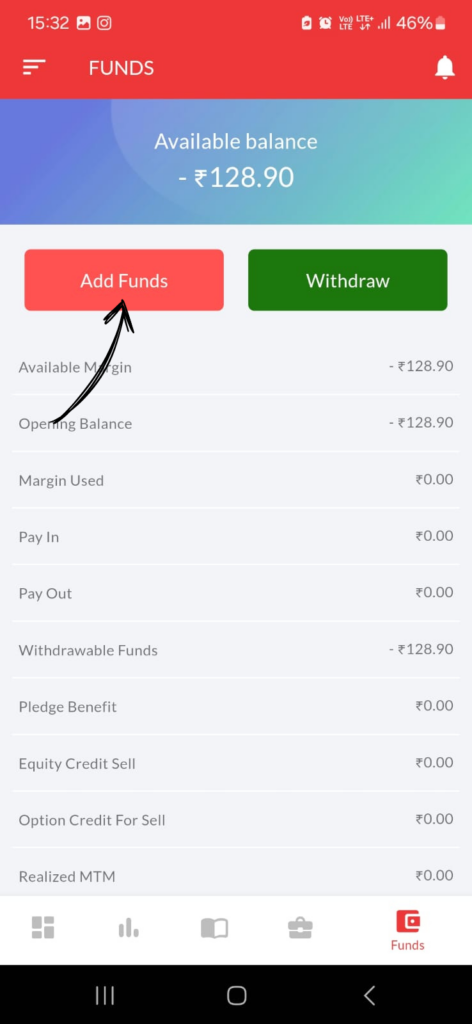

2. Tap on Add Funds

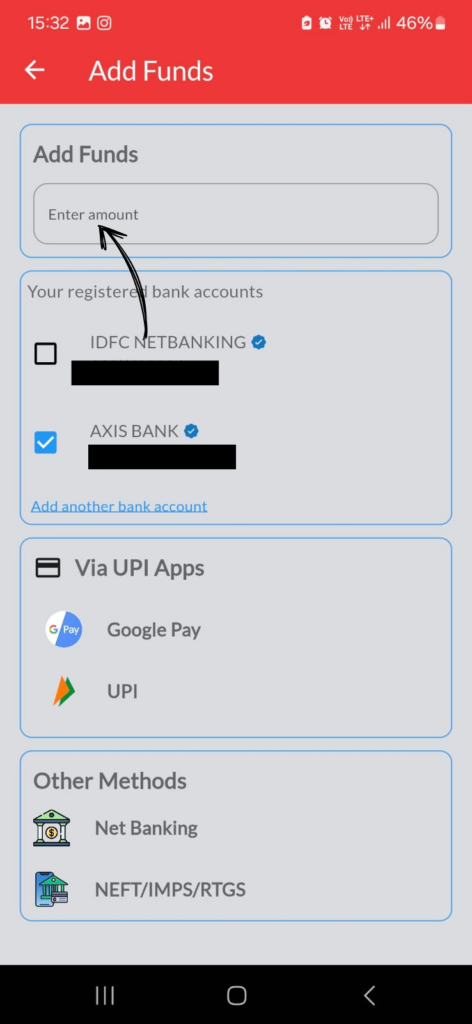

3. Type amount in the blank column.

4. Select registered bank A/c, if the client has registered more than 1 bank a/c with us.

5. Select the UPI App whichever is installed in your mobile.

6. It will automatically open the UPI APP.

7. In case you have no UPI App in your mobile , you can select net banking option. It will automatically open your registered bank internet banking login page.